貴金屬

Precious metals, including gold, silver, platinum, and palladium, have long been valued for their intrinsic qualities and financial stability. These metals are crucial for various industries, such as manufacturing and technology, and are often considered safe-haven assets during times of economic uncertainty. Trading precious metals through Contracts for Difference (CFDs) offers a flexible and accessible way to speculate on their price movements without the need to own the physical assets.

METALS

What Are Precious Metals CFDs?

Contracts for Difference (CFDs) are financial derivatives that allow traders to speculate on the price movements of underlying assets, such as precious metals. When you trade a CFD on a precious metal, you enter into a contract with a broker to exchange the difference in the price of the metal from when the contract is opened to when it is closed. If the price moves in your favor, you earn a profit; if it moves against you, you incur a loss.

保證金計算器

Benefits Of Trading Precious Metals CFDs:

槓桿作用

CFDs offer the ability to control a larger position with a relatively small amount of capital, which can amplify potential returns. However, leverage also increases risk, so it should be used with caution.

Flexibility

Traders can take both long (buy) and short (sell) positions, allowing them to profit from both rising and falling markets.

Diverse Market Access

Precious metals CFDs provide access to a range of metals, including gold, silver, platinum, and palladium, each with its own market dynamics.

No Physical Handling

Trading CFDs means you do not need to physically store or transport the metals, simplifying the trading process.

Safe-Haven Asset Exposure

Precious metals, particularly gold, are often seen as safe-haven assets, which can be advantageous during periods of market volatility and economic instability.

Trade Different With

阿米萊克斯

緊密且具競爭力的點差

全系列產品均具有世界級的緊密且具競爭力的點差

超快的執行速度

我們始終致力於為我們範圍內的所有產品實現快速的執行速度。

靈活的

槓桿作用

交易槓桿高達 500:1,允許相對於交易資本增加部位規模。

Amillex 產品

Forex Market Spreads, Commissions And

掉期

點差、掉期利率及佣金欄僅供參考。掉期和佣金的貨幣是基於您的帳戶貨幣。

| 象徵 | 數位 | 平均價差 | 委員會 | 合約規模 | 長互換 | 空頭掉期 | 最大槓桿 | |

| Major Metals | ||||||||

| XAUUSD | Gold | 2 | 23 | 0 | 100 | -51.204 | 18.9942 | 500 |

| XAGUSD | Silver | 3 | 13 | 0 | 5000 | -7.13824 | 0.23424 | 250 |

| Minor Metals | ||||||||

| XCUUSD | Copper | 2 | 750 | 0 | 10 | -234.636 | 0.32544 | 50 |

| XPDUSD | Palladium | 2 | 210 | 0 | 100 | -24.84832 | 0.88548 | 50 |

| XPTUSD | Platinum | 2 | 90 | 0 | 100 | -24.8448 | -1.2388 | 50 |

| XAUAUD | Gold vs AUD | 2 | 68 | 0 | 100 | -67.656 | 2.03568 | 50 |

| 象徵 | 數位 | 平均價差 | 委員會 | 合約規模 | 長互換 | 空頭掉期 | 最大槓桿 | |

| Major Metals | ||||||||

| XAUUSD | Gold | 2 | 18 | 0 | 100 | -51.204 | 18.9942 | 250 |

| XAGUSD | Silver | 3 | 12 | 0 | 5000 | -7.13824 | 0.23424 | 250 |

| Minor Metals | ||||||||

| XCUUSD | Copper | 2 | 750 | 0 | 10 | -234.636 | 0.32544 | 50 |

| XPDUSD | Palladium | 2 | 210 | 0 | 100 | -24.84832 | 0.88548 | 50 |

| XPTUSD | Platinum | 2 | 90 | 0 | 100 | -24.8448 | -1.2388 | 50 |

| XAUAUD | Gold vs AUD | 2 | 68 | 0 | 100 | -67.656 | 2.03568 | 50 |

| 象徵 | 數位 | 平均價差 | 委員會 | 合約規模 | 長互換 | 空頭掉期 | 最大槓桿 | |

| Major Metals | ||||||||

| XAUUSD | Gold | 2 | 8 | 7 | 100 | -51.204 | 18.9942 | 250 |

| XAGUSD | Silver | 3 | 10 | 7 | 5000 | -7.13824 | 0.23424 | 250 |

| Minor Metals | ||||||||

| XCUUSD | Copper | 2 | 750 | 0 | 10 | -234.636 | 0.32544 | 50 |

| XPDUSD | Palladium | 2 | 210 | 0 | 100 | -24.84832 | 0.88548 | 50 |

| XPTUSD | Platinum | 2 | 90 | 0 | 100 | -24.8448 | -1.2388 | 50 |

| XAUAUD | Gold vs AUD | 2 | 68 | 0 | 100 | -67.656 | 2.03568 | 50 |

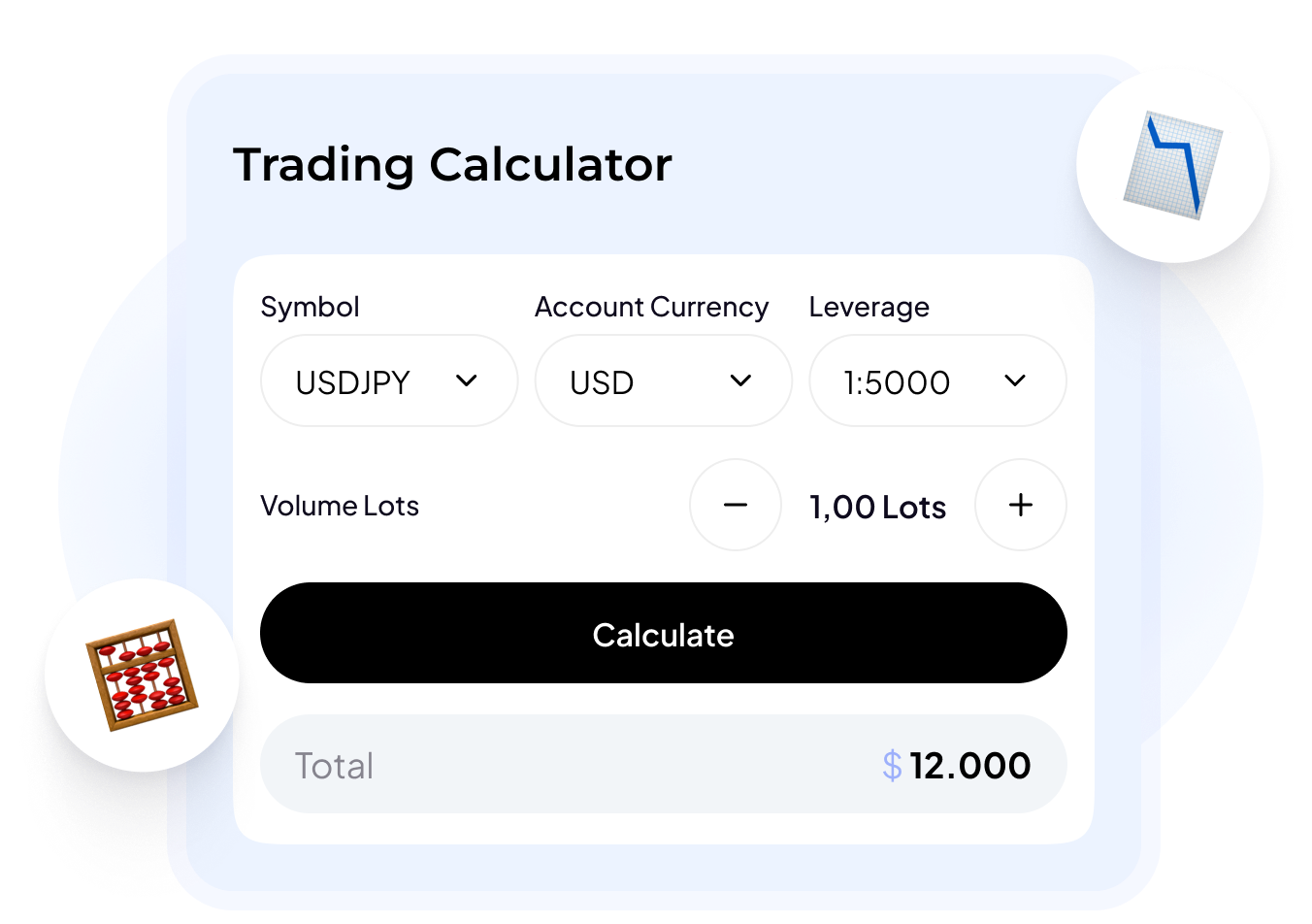

交易計算器

交易計算器

使用 Amillex 投資計算器簡化您的交易!即時計算點值、保證金、點差、佣金、隔夜利息等——所有這些都在一個易於使用的工具中。消除複雜交易計算中的猜測,專注於真正重要的事情:最大化您的策略。交易更明智。與 Amillex 進行不同的交易!

Frequently Asked Questions

How Does Dynamic Leverage Work?

Dynamic Leverage adjusts the leverage on individual symbols based on open position volume, helping to manage risk as positions grow. Here’s how it works for different asset categories:

Metals (Major Metals)

For major metals, the leverage for each new position on each symbol decreases as the existing open position volume increases:

- 0 – 5 Lots: Maximum leverage of 1:500

- 5 – 10 Lots: Maximum leverage of 1:250

- 10 – 20 Lots: Maximum leverage of 1:100

- 20 – 50 Lots: Maximum leverage of 1:10

- 50 Lots or more: Maximum leverage of 1:5

Forex (Major/Minor FX)

For major and minor Forex pairs, the leverage for each new position on each symbol decreases as the existing open position volume increases:

- 0 – 20 Lots: Maximum leverage of 1:500

- 20 – 50 Lots: Maximum leverage of 1:250

- 50 – 100 Lots: Maximum leverage of 1:100

- 100 Lots or more: Maximum leverage of 1:10

By progressively lowering leverage as open position volume increases, Dynamic Leverage helps manage the risks associated with larger positions, providing more stability and mitigating potential large losses in highly leveraged accounts.